Kathmandu. You return home from abroad who are interested to buy the goods is donation? Tribhuvan International Airport you know pairakhnos of-goods without customs Canst get and what to pay customs duties?

If you stood on the cell briefly returned foreign airport arrival Most Nepalis see large television brought. The last time foreign employment pharkimda LED television has been brought as usual.

Government workers have returned from foreign employment is a Rs 32 incasammko television also not charge customs. The government is not only television, returned from abroad brought many personal purposes duty exemption law has been exposed to the Customs Department Director General Shishir dhanganale information.

According to him, for personal purposes, such private provision is heavily packed and jhiti. And given the number of Customs to take advantage of the discount is too large.

Nepal to bring at least 1 year when 32 incasammako television is foreign held hunaparne law.

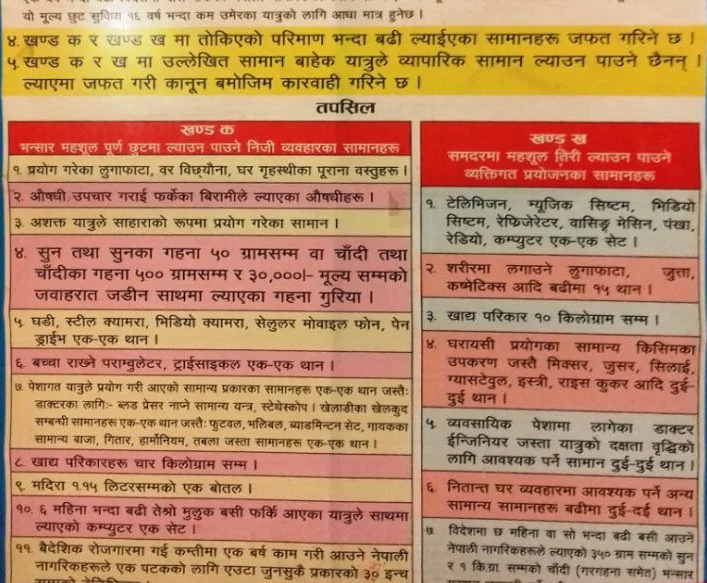

Tribuvan International Airport, according to the customs office of certain quantity of clothing, bedding, home and other old household goods lagayata personal use various materials to bring the customs sense.

Drug treatment abroad for citizens to bring their own medicine and physical disability assistance for the purpose of the item to be brought to a provision of the Customs.

Foreign specified quantity of gold is found to bring. 50 grams of gold and gold jewelry and silver jewelry, five hundred grams and price limit of 30 thousand Nepalese Rupee jaharata not have to pay customs charges connected to any ornaments.

Similarly, more than 50 grams and 3 hundred and 50 grams and 1 kg of gold and silver, then you have to pay customs duty on the specified prevailing. It is much more than silver and gold as they are not carrying bhansarapasa be confiscated. These facilities can also bring the same person more than 6 months should be held in foreign countries is a provision.

Similar to a laptop or computer, tablets, watches, cameras, video cameras, cellular, mobile phone and pen drive brings Customs tariff sets 1/1 found. The child who brought the customs taxes were perambaletara and Tricycle 1/1.

Various professional business person who brought home the goods returned to the customs arrangement. Blood pressure measuring device doctor, stethoscope, athletics, sports-related goods football, volleyball, music, musical instruments lagekaharule areas, guitar, harmonium, tabla, including money to pay duty on goods 1/1 sets.

If you feel the same four kg of food can bring 1.15 liters of alcohol duty-bearer of taxes.

Goods found to bring the prevailing customs duty

6 months abroad pharkiekaharule more than 32 inches television, music and video player, refrigerator, washing machine, fans, and radio and 1/1 rounds can bring. However, it must pay the prevailing customs. 10 kg found in food materials to bring, but if it toekio pay customs.

15 Peace clothing, shoes, cosmetics and other similar brings specific customs duty be brought TIA.

Mikscara brought for the household purposes, jusara, sewing machines, gyasatebula, iron, rice cooker comes up 2/2 thanasamma pay customs.

Business professionals, individuals can increase their efficiency required for goods for personal use can bring thanasamma 2/2. This item comes u

p more than jhiti gunta commercially as a probe to customs duty in providing mahanirdesika dhanganale have said.

Tribhuvan International Airport crucified Information View